The Four Essential Strategies for Long Term Wealth Creation: Strategy Two

Strategy Two: Make Sure All Fees Are Tax Advantaged

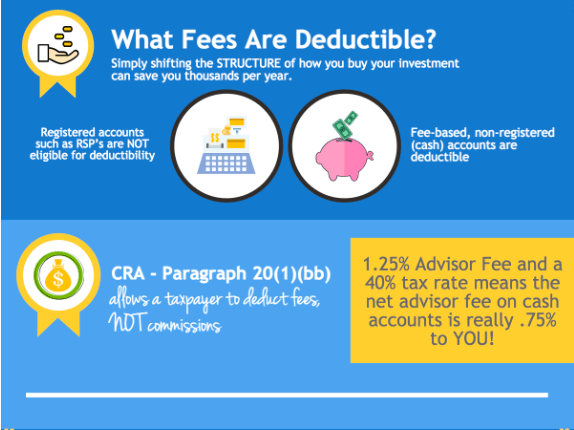

The Tax deductibility of the fees you pay is also critical to your total returns. Not all fees are tax deductible and that can make a huge difference in your returns over time.

When you work with a fee-only advisor, they will charge an investment counsel fee which is 100% tax-deductible. For example, if your tax rate is 40% and you pay an investment counsel fee of $3,000, then your net fee (after tax) is only $1,800.

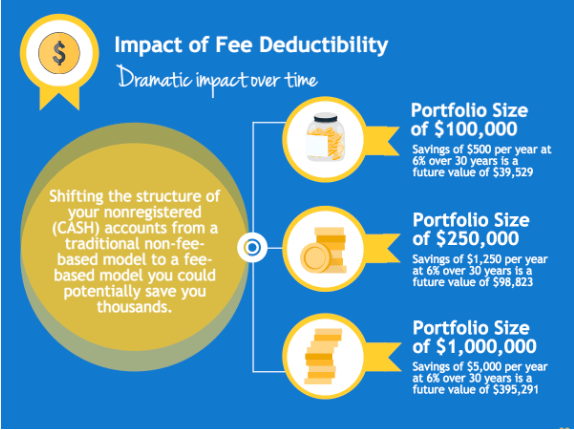

That $1,200 per year difference invested at 6% over 30 years means another $94,870 to you! That’s in addition to the extra money you earned in the lower fee examples above!

I hope you are starting to see why paying attention to fees and deductibility is so important. Each of these advantages compounds your investing advantage enabling you to reach your financial goals years earlier.

NOTE: Registered accounts such as RSP’s are NOT eligible for deductibility. Many advisors recommend wrapping registered fees through non-registered accounts in an attempt to make them deductible.

This is specifically prohibited by the tax code.

Fees can be deducted if they qualify on the following points:

- They have been paid for advice connected to the buying or selling of a specific investment

- They cover the cost of administering or managing an investment owned by the person making the claim

- They are not a commission

- They relate to advice on investments made in non-registered accounts. The CRA will deny a deduction of fees related to registered accounts including RRSPs, RRIFs, RESPs and TFSAs. An investor cannot circumvent this rule by charging fees related to a registered account to a non-registered account.

Source: Michelle Munro director, tax planning, for Fidelity Investments Canada ULC.

NOTE: You have to pay attention to deductibility because even a small .5% savings ($5,000) has a dramatic impact over time. Saving .5% on a $1M portfolio is worth $395,291 over 30 years. When investing for the long haul, what seem like tiny or inconsequential decisions are actually million-dollar decisions.

You might be asking yourself, “Where do I find the right Financial Consultant near me who charges a flat fee and will treat me fairly?” “Where can I find an advisor who can create an Integrated Aligned Overarching Strategy?” or “Where can I find an advisor who will only invest my money in proven passive investments? We suggest that you interview several. You’ll quickly learn that there are very few who are fiduciaries, believe in passive investing and have a process to create an Integrated Aligned Overarching Strategy. When you do find the right advisor, you’ll be able to relax in the knowledge that you are in the right hands and that your financial future is secure. Feel free to reach out to me with your questions. I’m committed to investor education.

Dean Kendall is a Financial Organizer in Calgary, handling all of the financial affairs for a select group of clients who value unbiased quality advice for one simple flat fee.

His book - Stop Paying Hidden Investment Fees! Click here for more information https://www.ideallifeexperience.com/Stop-Paying-Hidden-Investment-Fees

Newest book - Becoming The Champion of Your Dreams: How to Set and Achieve Your Most Important Goals Click here for more information. https://www.ideallifeexperience.com/Becoming-the-Champion-of-Your-Dreams

In addition, Dean is a 3X Canadian National # 1 Amateur, a 5X Canadian National #1 Professional BMX rider, downhill mountain biker and an avid snowboarder. He is an expert at winning. Let him show you how to win the money game. You can reach Dean at dean@ideal-life-experience.ca or Phone 403-543 -7226

©Copyright 2008 – 2022 by Dean Kendall. All rights reserved. 403-543-7226

dean@ideal-life-experience.ca