The Four Strategies for Long Term Wealth Creation: Strategy Three

Strategy Three: Use ONLY Passive Investing

There is a widely held myth among investors (perpetuated by banks, brokerage firms, portfolio managers and private investment counsel) that active investing can beat passive investment returns over time. It is a MYTH! When the higher costs of active investing are taken into account, it is nearly impossible to beat passive investing over time. Let’s clarify terms:

Humans are just plain drawn to the MYTH of active investing. Somehow, it just seems better to have a smart human investing our money. It just seems logical that with all the complexities of the markets in play that a smart human could make better decisions than a machine. It somehow FEELS safer. But that is your emotion talking.

The real logic is that you don’t want humans messing with the process because they can make errors of judgement and be emotional at the wrong times. The best way to get solid consistent investment returns is to KEEP COSTS LOW and stay invested in all market conditions. That means the only strategy that works consistently is low-cost passive investing. This has been proven over and over again but somehow emotional investors just can’t seem to accept the results.

Many studies by top academics provide overwhelming empirical evidence proving active

management does not outperform passive management when the higher fees of active

management are taken into account. Yet the majority of consumers tend to invest in these high cost underperforming strategies by buying into emotional sales pitches and the hope of market beating returns.

This video by some of the world’s top economists and academics makes it crystal clear that you simply cannot beat the market with active investing when its higher costs are taken into account.

https://www.youtube.com/watch?v=zqa-jSuXmYw

Let’s look at how some of the most respected investors on the planet think you should be investing your money?

David Swensen, Chief Investment Officer, Yale University

(Photo by Michael Marsland)

David Swensen has made an average return of 13.9 percent a year over the last 20 years for Yale, adding $20.6 billion to the university’s endowment. That gives him the best track record of any institutional investor.

“Low costs and diversification serve investors well,” he says.

Pay the lowest fees possible

Fees can do terrible damage to your investment returns. Even in higher-risk, higher-return asset classes such as stocks you can only expect high-single digit or low double-digit returns over long periods of time. So if you end up paying 1 percent to a financial adviser, and then 1 percent to 2 percent on top of that in mutual fund fees and then adjust for inflation (2 percent to 3 percent a year), you’re losing half of your returns or more.

He says “When you look at the results on an after-fee, after-tax basis over reasonably long periods of time,” the odds, he says, “are overwhelmingly in favor of index funds.”

Now let’s check in with the father of low-cost investing, Jack Bogle, founder of The Vanguard Group.

The George Washington of Investing Wants You For The Revolution

Jack Bogle created the world’s first index fund for ordinary people. He founded the Vanguard Group, which now manages $3 trillion. “Buy a stock index fund and add bonds as you age,” he says.

Bogle says to invest through low-cost index funds. (He created the first one after all.) With an index fund you’re not paying people on Wall Street to pick stocks for you. Instead, you basically “own all of corporate America,” he says — at least, a small slice. And over time, he says, low-cost index mutual funds outperform the vast majority of actively managed mutual funds. Picking winners with stocks is very hard to do, and for ordinary Americans, it just costs too much to invest that way, he says.

“Cost turns out to be everything,” Bogle says. “It’s just what I’ve always called the relentless rule of humble arithmetic”

“Simplicity underlies the best investment strategies. Basic arithmetic works. Keep your investment expenses under control,” he says. “Your net return is simply the gross return of your investment portfolio less the costs you incur [such as sales commissions, advisory fees, and transaction costs]. Low costs make your task easier.”

Stock Pickers have long-standing roots that date back to the days when stockbrokers/Investment Advisors, were the gatekeepers to financial markets. They continue to actively manage portfolios, picking the stocks and allocations needed to create their own model portfolios. Like Product Pitchers, Stock Pickers know their portfolio companies inside and out and appeal to a more mature clientele who want their advisor to be their “personal” portfolio manager. This is hubris and it is expensive.

Advisors will often use the phrase that “You get what you pay for” to justifying the additional costs for active management. That is simply not true. The Advisor, not the client, gets what you pay for! Clients say naively, that “Fees are not a big deal” or “As long as I am making money, who cares?” I hope by now you know the huge toll these extra fees can take.

The weakness of active management is that their success relies on their ability to “generate alpha,” (to perform better than a passive portfolio), a feat that has proven very difficult even for the most accomplished institutional investor after accounting for fees.

Remember, active managers have to outperform their extra expenses before they can start to make a profit. This rarely happens in a single year and even more rarely year after year…

Very few active managers ever outperform their index, and for you to benefit from that rarity, you would have to identify the right advisor in advance. For some crazy reason, they never let you invest in their PAST returns! Even when they do beat their index, the statistical likelihood is that they will revert to the mean as soon as you give them your money. In other words, even if they have succeeded in beating the market in the past, statistically speaking, their returns are likely to be lower in the future.

What Does The Oracle of Omaha Say About Passive vs. Active?

“Most investors, both institutional and individual, will find that the best way to own common stocks is through an index fund that charges minimal fees. Those following this path are sure to beat the net results (after fees and expenses) of the great majority of investment professionals.” — Warren Buffett, 1996 (IFA 2014)

Warren Buffet (Photo courtesy of Business Insider)

What Are They Thinking?

Despite the evidence that passive investment strategies offer better results for investors, the

majority of advisors in Canada continue to recommend actively managed mutual funds and other similar products that include high fees. There is no other logical conclusion to draw other than it is because of their embedded compensation structures.

Although high fees and consistent underperformance characterize Canada’s mutual fund industry, investors continue to purchase actively managed mutual funds at a surprising rate. As of November 2014, Canadian’s held more than $1 trillion dollars in mutual fund assets according to the Investment Funds Institute of Canada, and purchased more than $60 billion dollars’ worth of new mutual fund assets in 2014 alone (IFIC 2014). Mutual funds are the most commonly held investment product in the country, with 62% of Canadians holding mutual funds in their investment portfolios (Investor Economics / CSA 2012)

It’s hard to imagine that Canadians would continue to purchase high fee mutual funds delivering sub-par performance if financial advisors were held to a fiduciary standard that required them to act in their client’s best interests.

What Needs to Be Done

Without misaligned incentives distorting the advice being provided, low-cost index-based investments would be more frequently recommended over high-cost actively managed ones. As a result, consumers would receive more objective and cost conscious advice that would help to improve their returns over the long run.

To be excessively clear, it is a Myth that active managers and / or investment advisors can pick funds or individual stocks that will do better than others. Nobel Prize winning minds like Eugene Fama (The Father of Modern Finance) and others have proven that this is impossible over the long run. If you are still unconvinced, you may want to research “The Efficient Market Hypothesis” which provides overwhelming evidence of the difficulty of beating the markets over time.

The IMPACT of Investment Style on You

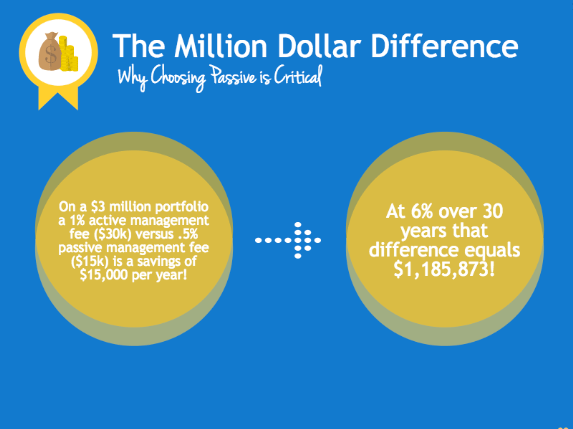

On a $1 million portfolio, a 1% active management fee versus a .5% passive management fee means the difference between a $10,000 fee vs. a $5,000 fee each year. The $5,000 per year difference invested at 6% over 30 years equals $395,291.

On a $3 million portfolio a 1% active management fee versus .5% passive management fee is $30,000 versus $15,000 meaning savings of $15,000 per year. At 6% over 30 years that difference equals $1,185,873!

On a $5 million portfolio, a 1% active management fee versus .5% passive management fee is $50,000 versus $25,000 meaning a savings of $25,000 per year. At 6% over 30 years that difference comes to a whopping $1,976,455

You might be asking yourself, “Where do I find the right Financial Consultant near me who charges a flat fee and will treat me fairly?” “Where can I find an advisor who can create an Integrated Aligned Overarching Strategy?” or “Where can I find an advisor who will only invest my money in proven passive investments? We suggest that you interview several. You’ll quickly learn that there are very few who are fiduciaries, believe in passive investing and have a process to create an Integrated Aligned Overarching Strategy. When you do find the right advisor, you’ll be able to relax in the knowledge that you are in the right hands and that your financial future is secure. Feel free to reach out to me with your questions. I’m committed to investor education.

Dean Kendall is a Financial Organizer in Calgary, handling all of the financial affairs for a select group of clients who value unbiased quality advice for one simple flat fee.

His book - Stop Paying Hidden Investment Fees! Click here for more information https://www.ideallifeexperience.com/Stop-Paying-Hidden-Investment-Fees

Newest book - Becoming The Champion of Your Dreams: How to Set and Achieve Your Most Important Goals Click here for more information. https://www.ideallifeexperience.com/Becoming-the-Champion-of-Your-Dreams

In addition, Dean is a 3X Canadian National # 1 Amateur, a 5X Canadian National #1 Professional BMX rider, downhill mountain biker and an avid snowboarder. He is an expert at winning. Let him show you how to win the money game. You can reach Dean at dean@ideal-life-experience.ca or Phone 403-543 -7226

©Copyright 2008 – 2022 by Dean Kendall. All rights reserved. 403-543-7226

dean@ideal-life-experience.ca