The Four Essential Strategies for Long Term Wealth Creation: Strategy One

Strategy One: Know What Fees You Are Paying and Keep Fees Low

With all the rankings showing Canada among the worst in fees for financial products, most

investors have at least an inkling that their investing costs are high. But investors seem to have little understanding of how high-priced investments can sap portfolio growth and extend the time to reach your goals by years.

Minimizing costs should be a critical part of every investor’s strategy, because every dollar paid in management fees or trading commissions is one dollar not available to drive potential returns. With average management expense ratios of about 2.5% and the added costs of commissions and embedded trading costs within actively managed investments, the costs can easily exceed 3% annually. The right advisor should drop your costs by at least 1% per year and a good flat fee model could drop the cost by 2% per year or more.

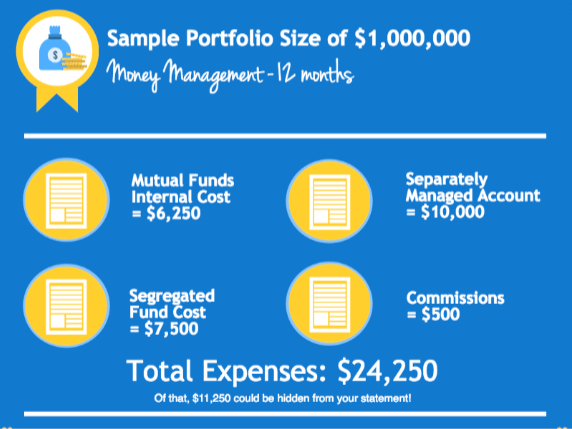

Example of High and Hidden Fees - 1 Million Dollar Portfolio:

So let’s take a look at how fees impact you on a sample hypothetical portfolio of 1 million dollars. This is how fees typically break down. Let’s assume $250,000 is invested in mutual funds with a 2.5% management expense ratio. $250,000 is invested in a segregated fund with a 3% management expense ratio. $500,000 is invested in a separately managed account with a 2% management expense ratio and a commission of $500. You would be paying $24,250 in fees, most of them hidden. The annual fee is 2.425% which means the investment has to generate a return higher than this before you make any money at all!

Hidden Fees: Of the $24,250 that is being charged up to $11,250 may not even show up on your statement. For example, for the mutual fund with $6,250 in total costs only a fraction of the fee will appear on your statement. The amount will be what the dealer receives which is approximately 1% of the $250,000 invested which is $2,500. That’s $3,750 dollars in hidden fees!

For the segregated fund with $7,500 in total costs no fees are mandated to appear on your

statement, for a total of $11,250 in hidden fees!

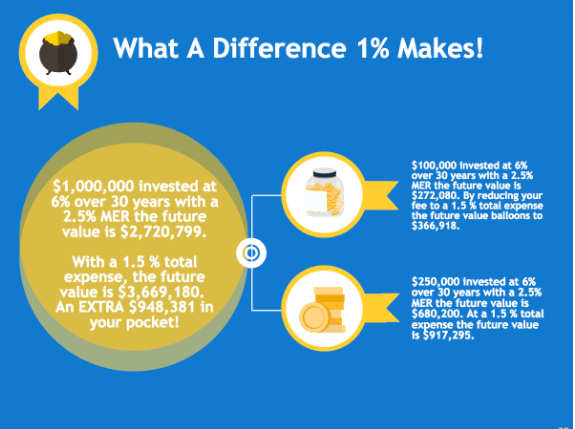

The IMPACT of Hidden Fees - How Much of a Difference Could 1% Make?

Would you believe nearly One Million Dollars?

So what is the impact of those fees on you? It is just not just the fees you are paying now. Each year you pay $11,250 in hidden fees multiplied by the number of years you hold the investment times the lost interest over 30 years. Compounded over the life of your investment, those hidden fees will cost you almost a million dollars.

NOTE: Rule of thumb to remember. A 1% difference in fees will mean a difference in returns to you of just about your entire original investment over 30 years. Are you choosing to make your advisor a millionaire, or do you have better uses for that money yourself?

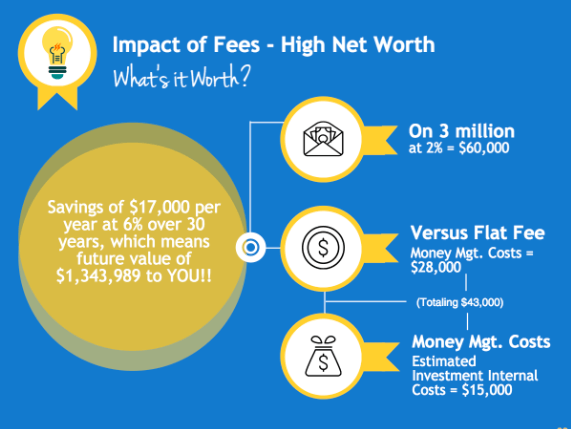

Example of High and Hidden Fees - 3 Million Dollar Portfolio:

Let’s take a look at how fees impact a sample high net worth portfolio of $3 million. Let’s assume all the money is invested in a separately managed account with a 2% total fee (advisor fees and investment management fees of $60,000). I am using a separately managed account because that is what would be typical for this size portfolio.

Contrast this with a flat fee advisor charging $28,000 plus a .5% MER for investment management equaling $15,000 for a total fee of $43,000. The flat fee means an annual savings of $17,000 per year. At 6% over 30 years you would have an additional $1,343,989 in your portfolio. That approaches 50% of your original $3 million investment. Those are astounding numbers!

Do you feel you are getting an extra 1.3 million dollars in services over what you could get elsewhere? I doubt it. You might be getting free dinners or front row seats to the opera or the Stanley Cup, but are they worth $1.3 million?? If this is your retirement portfolio, do you really want to work all those extra years just to pay fees to your advisor?

Note: The flat fee paid to the advisor should come with a clearly defined list of services (or deliverables) that you will receive each year for that fee. In my case, that flat fee for Truly Comprehensive Financial Services™ includes Financial Planning, a Complete Insurance review, Tax Planning and Minimization, Investment Advice and Estate Planning advice, plus a review of 143 checkpoints covering all areas of your personal financial situation. It also includes the advice of my team of Subject Matter Experts and 3 in-person meetings per year to discuss your situation.

If your advisor is not providing a clearly defined list of services for the fees charged, you should ask him or her to put such a list in writing for you so that you know exactly what you are getting for what you are paying.

You might be asking yourself, “Where do I find the right Financial Consultant near me who charges a flat fee and will treat me fairly?” “Where can I find an advisor who can create an Integrated Aligned Overarching Strategy?” or “Where can I find an advisor who will only invest my money in proven passive investments? We suggest that you interview several. You’ll quickly learn that there are very few who are fiduciaries, believe in passive investing and have a process to create an Integrated Aligned Overarching Strategy. When you do find the right advisor, you’ll be able to relax in the knowledge that you are in the right hands and that your financial future is secure. Feel free to reach out to me with your questions. I’m committed to investor education.

Dean Kendall is a Financial Organizer in Calgary, handling all of the financial affairs for a select group of clients who value unbiased quality advice for one simple flat fee.

His book - Stop Paying Hidden Investment Fees! Click here for more information https://www.ideallifeexperience.com/Stop-Paying-Hidden-Investment-Fees

Newest book - Becoming The Champion of Your Dreams: How to Set and Achieve Your Most Important Goals Click here for more information. https://www.ideallifeexperience.com/Becoming-the-Champion-of-Your-Dreams

In addition, Dean is a 3X Canadian National # 1 Amateur, a 5X Canadian National #1 Professional BMX rider, downhill mountain biker and an avid snowboarder. He is an expert at winning. Let him show you how to win the money game. You can reach Dean at dean@ideal-life-experience.ca or Phone 403-543 -7226

©Copyright 2008 – 2022 by Dean Kendall. All rights reserved. 403-543-7226 dean@ideal-life-experience.ca