Reason #5 They have an Active investing bias

28 Reasons Why Successful People Fail At Investing: Reason #5 They have an Active investing bias

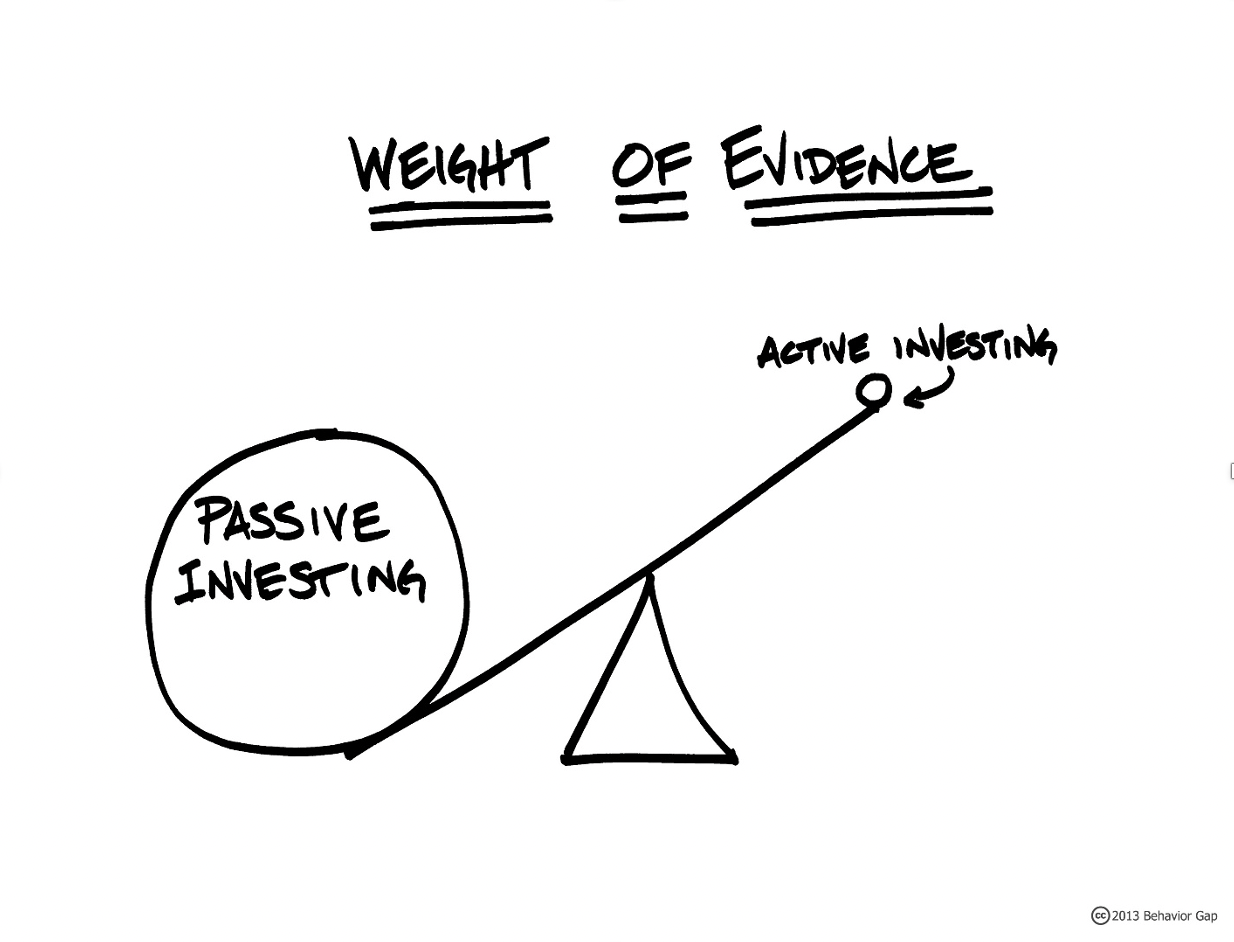

There is a widely held myth among investors (perpetuated by banks, wealth managers, financial advisors, brokerage firms, portfolio managers, and private investment counsel) that active investing can beat passive investment returns over time. It is a MYTH! When the higher costs of active investing are taken into account, it is nearly impossible to beat passive investing over time. It’s time the financial media came out and told people that active investing is a losing strategy.

It doesn’t matter how many reports come out of Morningstar, SPIVA, Universities around the world, a Nobel Prize winner showing that active managers do not outperform in the long term; there are some people who just won’t change their minds. People continue to be duped and invest in active management products that are recommended and sold by the vast majority of all financial institutions and wealth management firms.

Morningstar’s global director of ETF research Ben Johnson makes this point in a recent video.

He says: “This concept that active managers will reliably outperform in environments like we experienced earlier this year belongs in the same category as Santa Claus and the Easter Bunny.

“It’s a myth, it’s one that perpetuates itself… because people want to believe.”

Without misaligned incentives distorting the advice being provided, low-cost index-based investments would be more frequently recommended over high-cost actively managed ones. As a result, consumers would receive more objective and cost-conscious advice that would help to

improve their returns over the long run.

To be excessively clear, it is a Myth that active managers and/or investment advisors can pick funds or individual stocks that will do better than others. Eugene Fama (The Father of Modern Finance) won a Nobel Prize proving that passive outperforms active, period. Fama warns investors against the lure of active management and when asked, when is active management good? The answer is never. Regardless of the facts being presented people simply believe active management is best. Just because you want to believe it, will not make it true!

https://www.ideal-life-experience.ca/the-active-investing-myth

You might be asking yourself, “Where do I find the right Financial Consultant near me who charges a flat fee and will treat me fairly?” “Where can I find an Advisor who can create an Integrated Aligned Overarching Strategy?” “Where can I find an advisor who will only invest my money in proven passive investments? We suggest that you interview several. You’ll quickly learn that there are very few who are fiduciaries, believe in passive investing, and have a process to create an Integrated Aligned Overarching Strategy. When you do find the right advisor, you’ll be able to relax in the knowledge that you are in the right hands and that your financial future is secure. Feel free to reach out to me with your questions. I’m committed to investor education.

If you are ready to get really serious about living your Ideal Life and getting your financial house in perfect order, please call me at 403-543-7226 or email me at dean@ideal-life-experience.ca to get started. I look forward to working with you to reach all of your goals.

Dean Kendall is a Financial Organizer in Calgary, handling all of the financial affairs for a select group of clients who value unbiased quality advice for one simple flat fee.

His book - Stop Paying Hidden Investment Fees! Click here for more information https://www.ideallifeexperience.com/Stop-Paying-Hidden-Investment-Fees

Newest book - Becoming The Champion of Your Dreams: How to Set and Achieve Your Most Important Goals Click here for more information. https://www.ideallifeexperience.com/Becoming-the-Champion-of-Your-Dreams

In addition, Dean is a 3X Canadian National # 1 Amateur, a 5X Canadian National #1 Professional BMX rider, downhill mountain biker, and an avid snowboarder. He is an expert at winning. Let him show you how to win the money game. You can reach Dean at dean@ideal-life-experience.ca or Phone 403-543 -7226

Copyright 2008 – 2022 by Dean Kendall. All rights reserved. 403-543-7226 dean@ideal-life-experience.ca