How do I make Wise and Safe Investments?

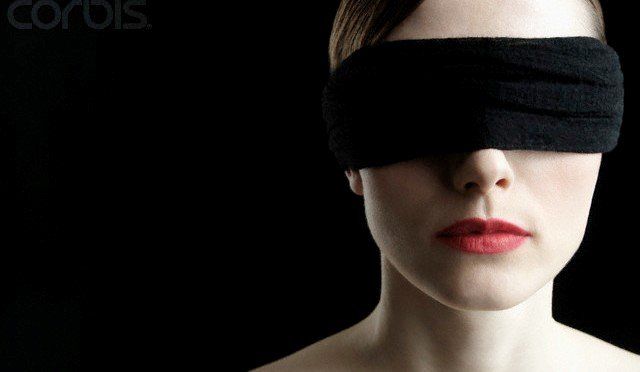

In my past experience, people have a real blind spot regarding their vision for the future, and as a result, often make quick but poor financial decisions. They have no “real” financial strategy. They pick up stocks, investments or insurance randomly over the years and hope that they end up with a big pile of money that will meet all of their needs for retirement, education, housing, health needs and more.

STOP, BREATHE, THINK!

It’s time to hit the reset button, get off the treadmill and sit down with a professional who will help you co-create your ideal life vision.

Let me provide some context. The way most people think about money. “I’ll just work hard to accumulate a big pile of money then I’ll be able to retire and do whatever I want,” they say.

But this strategy is dead wrong because the process shouldn’t start with money, it should start with a design for your Ideal Life…your end goal. “What do you want your Ideal Life to look like, sound like and feel like and how much will you need at each stage of your life to support your vision? Without a plan, you don’t know how big of a pile of money you really need and how it should be structured to reduce taxes as much as possible while still providing the liquidity you need at the times you need it. If you’re working too much, you are trading something – your priorities (health, family, relationships etc.) for an extra-large pile of money you may not need.

In my experience, many people are stuck in an old paradigm. They are 65 and feel there is nothing they can do. Or they say. “I wish I had met you 20 years ago”. Well the reality is they still have 20 to 30 + years to go! There’s lots they can do. The time to act is NOW.

Money comes last, your vision for your ideal life comes first.

Remember, money is a tool that supports the accomplishment of your vision, values and goals. The wealth management industry is full of salespeople selling products and tactics. What you need to make smarter financial decisions and be stress free is an Integrated Aligned Overarching Strategy, a living document that is adjusted constantly as you move forward in life. It is a prioritized step by step written plan of action.

It answers many common questions like, am I on track or off track to achieving my goals? What is the best way to drawdown or monetize my assets and retirement savings? How do I minimize my taxes during retirement? (Many prefer the term financial freedom) How much do I need to retire? How should my money be invested now and in retirement? Am I saving enough for retirement? When does work become optional for me?

It should outline your current reality and should clarify if you are on track or off track to your goals. It highlights actionable items and details course corrections, allowing you to actualize your ideal financial future years earlier than you would without a plan. Just like your health, you cannot have a one-time checkup with your doctor and expect your health to magically stay on track.

With a well-designed financial strategy in place, it becomes possible to lower your stress and live into your Ideal Life vision today, not in some imaginary future. It becomes possible to shift mental energy away from financial issues and towards what matters most to you in life.

A Financial Road Map® is a tool we use to integrate your values, goals and finances together so you have a clear VISION for the future. We then create an Integrated Aligned Overarching Strategy that we continuously update as life changes.

The best decision you can make right now is to consider a new possibility and experience the creation of your own Financial Road Map®.

You might be asking yourself, “Where do I find the right Financial Consultant near me who charges a flat fee and will treat me fairly?” “Where can I find an advisor who will only invest my money in proven passive investments? We suggest that you interview several. You’ll quickly learn that there are very few who are both fiduciaries and believe in passive investing. When you do find the right advisor, you’ll be able to relax in the knowledge that you are in the right hands and that your financial future is secure. Feel free to reach out to me with your questions. I’m committed to investor education.

Dean Kendall is a Financial Organizer in Calgary, handling all of the financial affairs for a select group of clients who value unbiased quality advice for one simple flat fee.

His latest book is Stop Paying Hidden Investment Fees! Click here for more information https://www.ideallifeexperience.com/Stop-Paying-Hidden-Investment-Fees

In addition, Dean is a 3X Canadian National # 1 Amateur, a 5X Canadian National #1 Professional BMX rider, downhill mountain biker and an avid snowboarder. He is an expert at winning. Let him show you how to win the money game. You can reach Dean at dean@ideal-life-experience.ca or Phone 403-543 -7226.

Copyright 2008 – 2020 by Dean Kendall. All rights reserved. 403 543 7226 dean@ideal-life-experience.ca