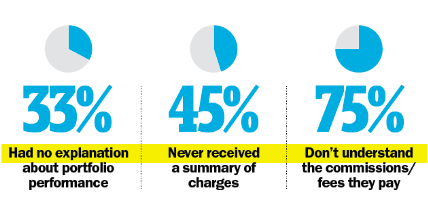

I have yet to meet a new client who can accurately and clearly articulate to me how much they pay in fees related to their investments, their financial advisor or institution. This seems crazy and hard to believe, yet it is reality. There is clearly a lack of disclosure and transparency with financial advisors and institutions. As a result, many people are making uninformed decisions without all the facts around fees. They continuously engage advisors and institutions, making investment decisions based on blind faith or emotion. There is overwhelming evidence of a lack of disclosure and transparency in the financial services industry.

I will warn you up front that this is a very depressing chapter. I have attempted to accurately document, through trusted third party sources, the level of obfuscation of fees and unscrupulous practices by advisors and Canadian Institutions and to show the extent of the problem. If you already understand the depth and extent of the problem, you may wish to skip this chapter and move directly onto what to do about it in Chapter Three. If you have a strong stomach and are ready to learn about how widespread and disgusting the hidden fee crisis is, take a deep breath and read on. It is a long, thorough and detailed chapter designed for those who really want to understand the details. Feel free to bail out whenever you feel you have had enough. The following chapters will bring much better news.

No Axe to Grind

I don’t have an ax to grind. I am not “against the industry.” I merely want all fees and charges to be clearly disclosed in plain language up front. Then it will be up to consumers and investors to make the right choices. But don’t just take my word for the dismal state of the industry. Learn for yourself by looking at what the news media has to say about the industry, advisors and hidden fees.

CBC News: A

Marketplace report

This report looked at Canada's five biggest banks — CIBC, Royal Bank, Toronto-Dominion Bank, Bank of Montreal and Scotiabank — and found most offer little clarity on how the fees work and how much they cost. Here is the link:

Banks misleading clients on mutual funds - Canada - CBC News

(Fee Grabber # 3 shows how hidden mutual fund fees can cost $100,000 or more! This segment starts at 13 minutes into the video)

Now, let’s take a look at what Peter Mansbridge has to say…

http://tinyurl.com/Hidden-camera-investigation

Canadians are allowing themselves to be gouged, and losing a great deal of their own money in the process - Amanda Lang, CBC NEWS

http://preview.tinyurl.com/Investment-fees-are-too-high

It makes you wonder who has your back

Many people have a false sense of security when working with some of the big brand-name financial institutions. They somehow feel that there is an additional layer of security or protection with these institutions. This couldn’t be farther from the truth.

It is clear from the Marketplace report that some of Canada’s largest institutions are failing to operate in their client’s best interest. These institutions have deep pockets, massive marketing budgets, and brand awareness, but these characteristics are not the proper metric for professional competency or service levels delivered to the client. Big brand names do not protect you, there is no additional level of security because of their brand name.

What Third Party Ratings Companies Say

Canada Was Rated Worst…

In a 2015 global study by Morningstar, a fund ratings company, Canada was rated the worst in the developed world when it came to Fees and Expenses incurred by investors. (Behind China who scored a D+)

But wait! There is good news! Our score is up from the F we earned in 2013.

The real question for you is “What are the implications to you of Canada’s less-than-impressive grade. Are you paying too much in investment fees? The short answer is likely a resounding “Yes!”

The Morningstar Report and How We Fared

Morningstar’s 195 page report ("Global Fund Investor Experience Study") measures twenty-five countries in four categories. It includes an analysis of over 500,000 different funds. The report grades countries on Regulation and Taxation, Disclosure, Fees and Expenses, Sales and Media. Countries receive an A-F in each category, plus an overall score.

For Fees and Expenses, the highest-scoring country (that is, the country with the lowest costs to investors) is the U.S., a position held since the start of this study in 2009 and reflective of the scale of this market and, as discussed later, sales practices. Australia and the Netherlands join the U.S. with an A grade.

Among the lowest-scoring markets are Canada and China, which, while not the most expensive in all categories, do not have any category where fees are at an average or better level.

Fees and Expenses make up 25% of a country’s overall grade in this report.

Many studies by Morningstar and others have demonstrated that the most consistent predictor of a fund’s net performance over time is the level of its annual expenses. Clearly, the best practice from an investor’s viewpoint is to have access to—and purchase—funds that have lower annual costs. Global Fund Investor Experience Study June 2015 – Morningstar.

To learn more about the unnecessary fees you may be paying to your advisor or institution, download a FREE copy of Stop Paying Hidden Investment Fees using the following link: https://www.ideallifeexperience.com/Stop-Paying-Hidden-Investment-Fees

Dean Kendall is a Financial Organizer in Calgary, handling all of the financial affairs for a select group of clients who value unbiased quality advice for one simple flat fee.

His book - Stop Paying Hidden Investment Fees! Click here for more information https://www.ideallifeexperience.com/Stop-Paying-Hidden-Investment-Fees

Newest book - Becoming The Champion of Your Dreams: How to Set and Achieve Your Most Important Goals Click here for more information. https://www.ideallifeexperience.com/Becoming-the-Champion-of-Your-Dreams

In addition, Dean is a 3X Canadian National # 1 Amateur, a 5X Canadian National #1 Professional BMX rider, downhill mountain biker and an avid snowboarder. He is an expert at winning. Let him show you how to win the money game. You can reach Dean at dean@ideal-life-experience.ca or Phone 403-543 -7226

© Copyright 2008 – 2022 by Dean Kendall. All rights reserved. 403-543-7226 dean@ideal-life-experience.ca